About Us

Building a Better Quality of Life for Seniors Since 1977.

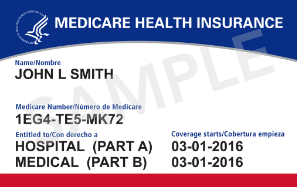

At the North Carolina Senior Citizens Association, our mission is to help beneficiaries understand the complicated world of health care and allow them to make the best decision for their particular set of circumstances. We help our senior friends weigh their options based on risk, medical history, finances and other variables so they arrive at a personalized solution that will equip them to live a healthy and cost-effective future.

Medi-Share 65+

Medi-Share 65+